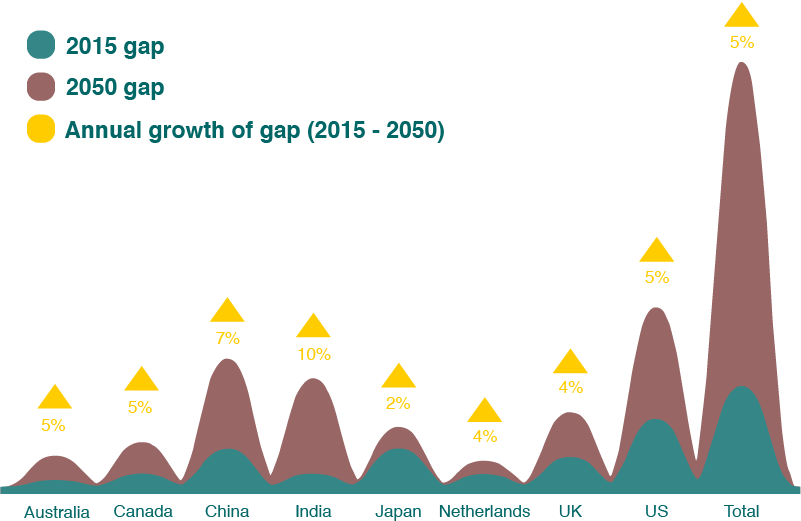

Pension Funding Gap Set to Overtake Global GDP

The World Economic Forum has calculated that pension systems across the United States, the United Kingdom, Japan, the Netherlands, Canada and Australia will have a joint shortfall of $224 trillion by 2050. If you add China and India to the equation, the combined gap nearly doubles to $400 trillion. That’s five times the size of the current global economic output. Such a shortfall places severe risks on the incomes and quality of life of future generations while setting the industrialized world up for one of the most widespread pension crises in history.

The Global Pension Crisis

Source: Mercer (2017)

Funding this shortfall will not be easy with global debt levels rising to more than 325% of GDP in 2017, reaching an eye-watering $217 trillion.…