“Emerging nations have great hunger and meeting this growing demand for food will require great investments to strengthen agriculture and make it more productive.”

Marc Garrigasait, President and Director of the Panda Agriculture and Water Fund, 2016

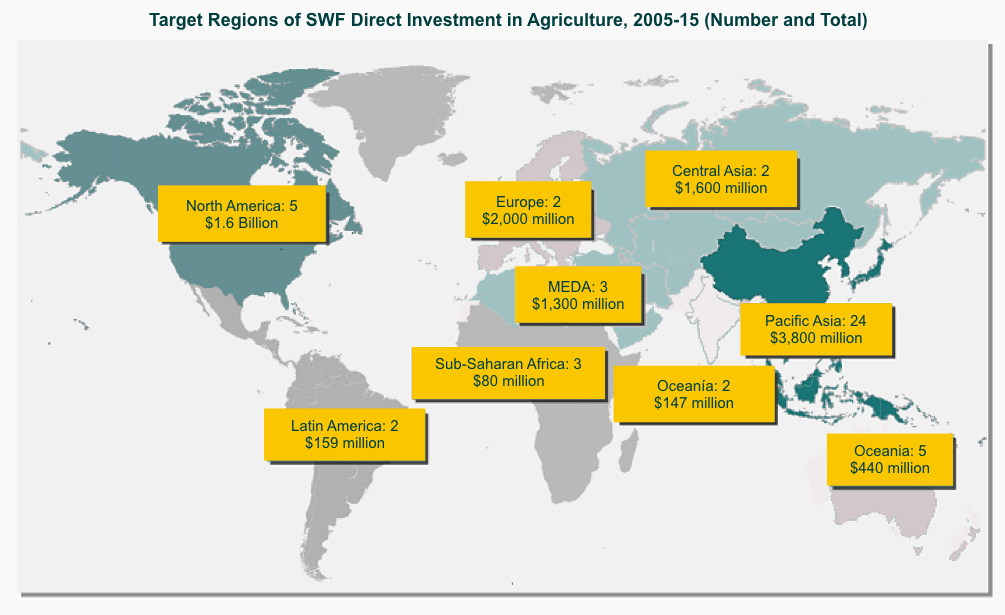

The growing demand for food across emerging economies is a point of great interest for the world’s largest institutional investors. Sovereign wealth funds are expected to drive a four-fold increase in agriculture investments over the next decade to a total of $240 billion.

A study of the world’s most lucrative Sovereign Wealth Funds by the Esade Business School, KPMG and Icex-Invest found that the current trends in the agricultural investment space point towards an impressive rise in asset allocation from $60 billion to $240 billion in the last decade. Agriculture has become a focus for institutional investors as the pressures of rising demand for food amid declining availability of arable farmland increases value.

Countries that import most of their food must develop strategies that limit their dependence on purchasing from a single country to ensure reliable supply of the most primal of needs, food. They have therefore begun to invest in the sector, both at home and abroad.

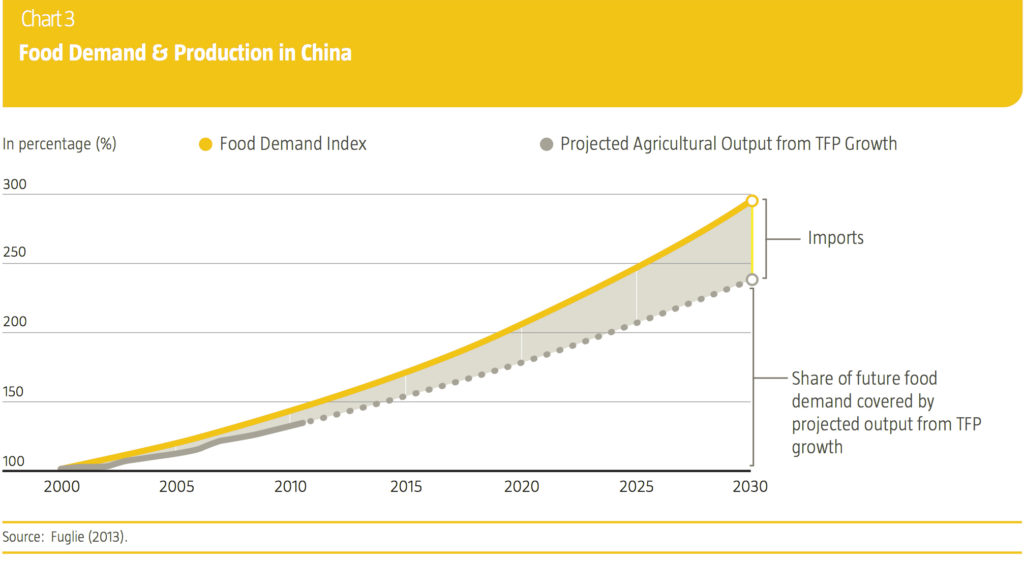

Since the early 1980s, China increased its GDP by a factor of 20, allowing 230 million people to move into the middle class. Over the next two decades this figure is expected to reach nearly one billion. Yet with only 110 million hectares of arable farmland available, a ratio of just 0.08 hectares/capita in the country is one of the lowest in the world. Their agricultural trade deficit is already on the verge of reaching $80 billion.

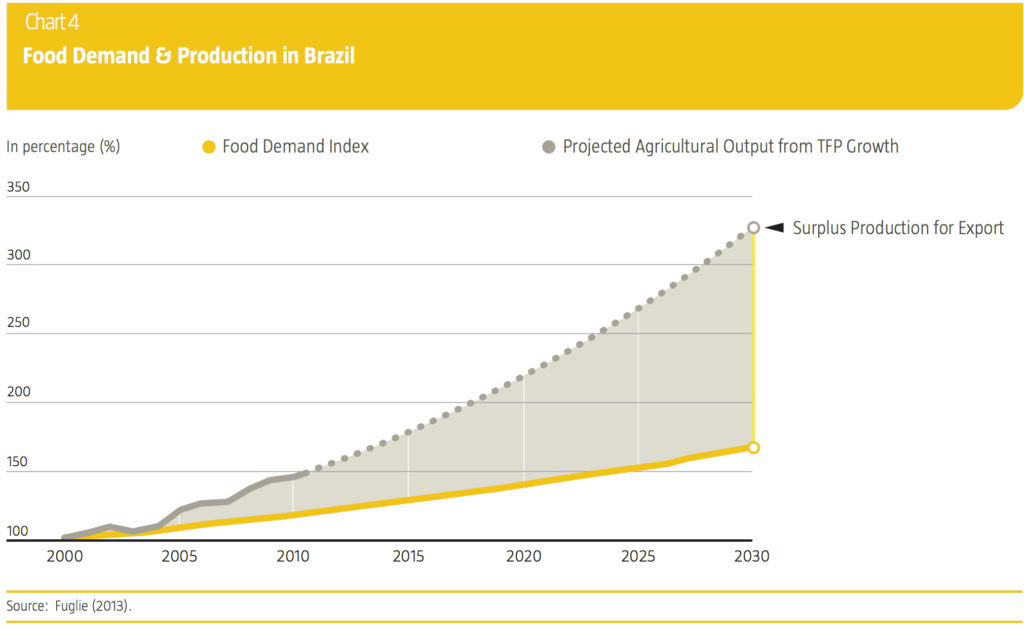

Food Demand & Production in China and Brazil Compared

Brazil’s dominance in food production has made China it’s largest export partner, comprising 18.6%

of total exports in 2015 according to IHS Markit.

The Chinese government’s response has been to invest in agriculture both at home and abroad. In June 2014, the President of China Investment Corporation announced the country’s intention to start a broad range of agricultural investments, following a period of much publicized ‘land grabs’ by the world’s richest countries following the Global Financial Crisis. Earlier this year, a $450 billion government stimulus into the domestic agricultural sector over the next four years was announced, the primary intention being to protect national food security.

This phenomenon has extended to other developed countries, as well as most of the countries in sub-Saharan Africa, emerging Asia and the Persian Gulf. All of these countries have two factors in common: populations that are relatively large and growing, against a low percentage of land suitable for cultivation. Asian countries currently show a total agricultural trade deficit of $159 billion, while Persian Gulf countries imported a net $27 billion dollars in food in 2011.

Such a paramount issue as the food supply and security is now attracting sovereign wealth funds due to the attractive market dynamics and offering diversification from traditional investments vehicles. In 2015, the Saudi Agricultural and Livestock Investment Company (SALIC) together with Brazilian company, Bunge, bought 50.1% of the Canadian Wheat Board, the second largest wheat exporter in the world, for $194 million. Groups such as Hassan Food, an exclusively agricultural fund linked to the Qatar Investment Authority, and Abu Dhabi Investment Authority have also been credited with interest in agricultural projects around the globe.

Agricultural farmland provides an attractive investment opportunity, but also provides the necessary services to support a thriving economy and ensure global health. According to the United Nations, investment in agriculture is one of the most important and effective strategies for economic growth and poverty reduction in rural areas where the majority of the world’s poor live. All eyes are now on agriculture to provide both financial and social advancements across the world.