With the European debt crisis, the United Kingdom leaving the European Union and China’s continued economic slowdown compounding fears of a global financial system teetering on the edge, there is no doubt that we are living in an age of social and economic uncertainty. One of our few certainties is mankind’s increasing rate of consumption. There are only so many natural resources the earth can supply and on 8th August 2016 we breached our annual limit.

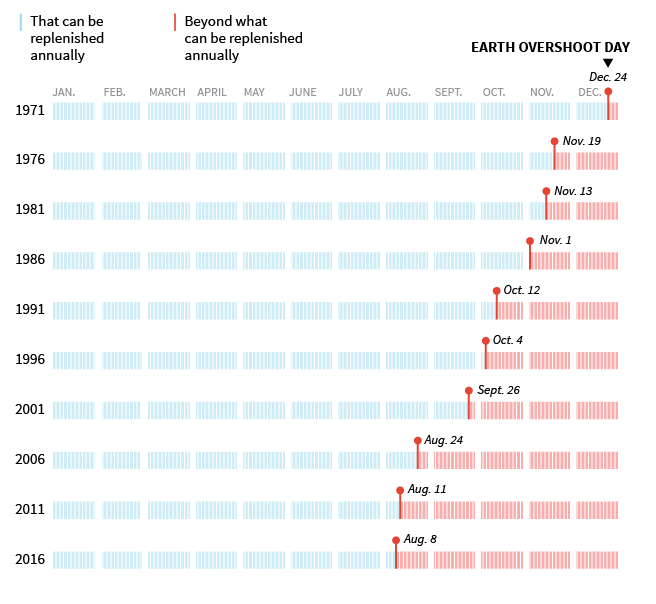

Earth Overshoot Day, also known as Ecological Debt Day, is when the human demand for natural resources exceeds what the planet can replenish annually. is the day when resource use outstrips our capacity for production, and is the point in the year when we have used as much land, trees and food that the planet’s ecosystem can regenerate. According the National Geographic, the first time this occurred was on December 29th, 1970. Since then the day has arrived earlier and earlier with each passing year – a major indication that the human race is using up natural resources at a much faster rate than ever before.

The Ecological Debt Day

The Global Footprint Network calculates Overshoot Day by comparing the planet’s biocapacity, the amount of ecological resources the Earth is able to generate in a year, with humanity’s demand. These resources include cropland, livestock, fish stock, forests for timber, space for urban infrastructure and carbon emissions. The world’s population currently consumes the equivalent of about 1.6 Earths every year. By 2030, we will need the equivalent of two entire Earths to support ourselves.

Combined efforts around the world to reduce humanity’s ecological footprint could profoundly alter this dire situation. If the global community reduced carbon emissions by 30% before 2030, Overshoot Day could be pushed back by an entire month. Another is to diversify our investments to alternative assets that hold fundamental value. While uncertainty in global financial markets has both investors and central bankers wary of the future, farmland values around the world are showing higher year-on-year growth and returns with lower levels of volatility.

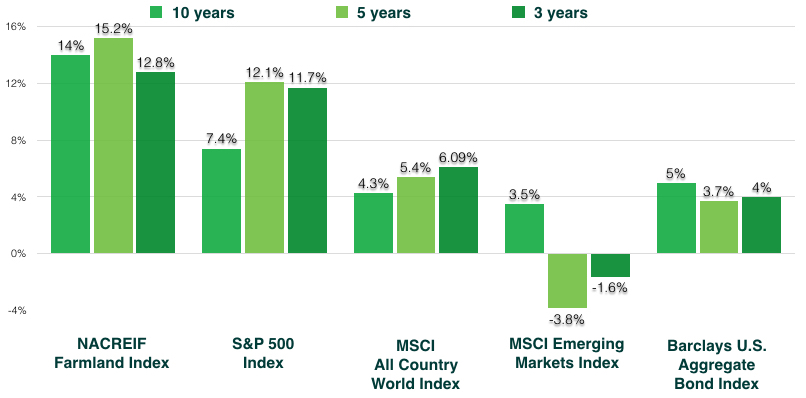

Comparison of Total Returns

Agricultural land, as measured by the US NACREIF Farmland Index, has outperformed both domestic stocks and bonds on an annualized basis over the last 40 years. The same applies worldwide, as global farmland prices have increased by an average of 20% from 2002-2013. A recent study by the University of Illinois’ TIAA-CREF Center for Farmland Research estimates that the global farmland investment opportunity represents $2.5 trillion.

Agriculture and farmland as an asset class is attractive more attention as investors diversify away from stocks and bonds. As populations and incomes grow across Asia, Africa and Latin America, so will the demand for richer food. After all, investment in the natural resources that sustain our daily lives is one of the most important and effective ways to build production and economic growth, reduce poverty and strengthen food security across the world.

We live in an environment and generation beset with new challenges. This has a particular resonance for the planet as it transitions to a more volatile period, both climatically and across traditional asset classes. Some of the changes are structural in nature and will have consequences that will impact our daily existence. Rapid population growth, resource depletion and commodity price volatility are set to endure, and the demand for farmland and agriculture products will rise.