For investors interested in Brazil the past few months have been exciting. The Temer administration continues to implement significant policies to increase investments and productivity in the country. Regulatory agencies have been transformed to improve governance and budget independence, there is a newfound prevalence of negotiation over once draconian labor legislation and the country’s famously protectionist tax system is in the process of being completely redesigned. For the first time in four years, the Central Bank has begun a rate-cutting cycle in October that trimmed its benchmark-lending rate to 14% from 14.25%. The Brazilian government has even launched the first package of 34 new infrastructure concessions that span across the agriculture, energy and transportation sectors. All of these policy moves will significantly reduce the cost of doing business in Brazil, making it a more attractive destination for foreign investment.

In the latest declaration to the world that Brazil is open for business, a new corporate law (LC155) has been passed in the country that eases regulation and facilitates direct investment for small and medium-sized enterprises aiming to expand in Latin America’s largest and most important market. LC155 allows angel investors, whether individuals or institutional funds, to invest in Brazilian SMEs without having to buy into the company’s equity, sharing a stake in the company’s debt or even being liable for any insolvency, bankruptcy or legal proceedings. A transformation from the red tape of Temer’s predecessors, this is a momentous step forward for the Brazil as the country establishes greater incentives towards innovative, technology-adaptive and productivity-enhancing corporate behaviors.

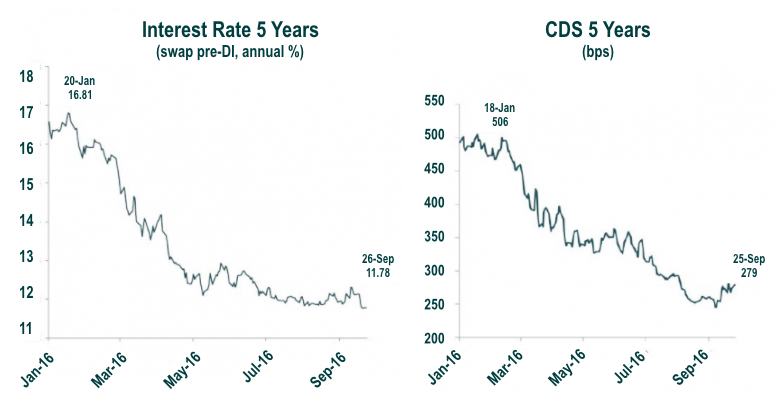

The Positive Evolution of Long Term Interest Rates and Risk Premium Levels in Brazil

Source: Bloomberg (2016)

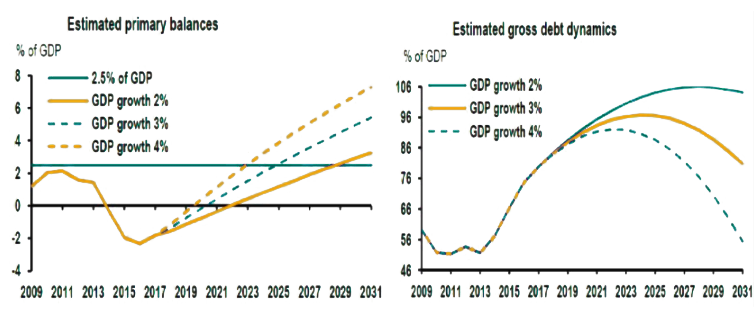

Another top priority for Brazil is to reverse a fiscal trajectory that was once based around substantial government transfers through generous pensions and social programs. While the previous system was fundamental in helping Brazil cut ‘chronic poverty’ by 75% from 2004-2012 and capture a higher position on global value chains in agriculture and energy, this was achieved during a period characterized by a super-cycle in commodities and an abundance of global liquidity. The macroeconomic conditions have changed considerably since then, and Temer has responded accordingly by proposing a system for capping government expenditure. This will be fundamental in securing Brazil’s return to positive economic growth, which the International Monetary Fund expects to occur in early 2017.

Global investors are responding very well to the center-right policies of Brazil’s new government, with the country attracting $8.4 billion in foreign direct investment in October (well above Reuters’ $6.5 billion forecast). One of the most substantial investors at the moment is Shell Oil, having recently announced that they will continue investing in Brazil to the tune of $10 billion over the next five years. This increase in investment should further boost the value of the Brazilian Real, which has successfully maintained its position as the world’s strongest currency performer this year.

On the Way to a Government Budget Surplus

The value of Brazilian assets have been pushed up in light of the government’s execution of center-right policies that will lead the way in reviving country’s economic performance. History often repeats itself and Brazil has the incredible opportunity to revisit the impressive economic growth and prosperity achieved throughout the majority of the last decade.