As the decision to impeach President Dilma Rousseff reaches the Senate, Brazil begins the search for a more responsible and fiscally reliable government to take the helm of the world’s second largest emerging market. This is an incredible opportunity for global investors as the ‘flash sale’ of deflated assets prices in recent years is coming to an end while the country initiates a full-scale political and economic transformation.

Arguably one of the most effective methods to ending a month-long political quagmire, a new administration would allow lawmakers and politicians to shift their focus towards closing the budget deficit and reviving growth in the economy. Rousseff’s departure would even demonstrate that Brazil’s democratic institutions, such as the Federal Police and Judiciary, are effectively solving the corruption scandals that have afflicted business and government over the past year. For the first time in two decades, meaningful reforms are on the agenda in Brazil and investors worldwide are taking note.

As Rousseff’s impeachment gains momentum, confidence in Brazilian prospects rises. Foreign Direct Investment in the country reached $56 billion in 2015 in spite of a severely weakened currency. Having already received the highest FDI in Latin America for over a decade, a change in leadership towards the center-right would further bolster Brazil’s position on the global stage and encourage even greater inflows of capital.

Brazil Continues to Receive the Highest Levels of FDI in Latin America

(Foreign Direct Investment in Brazil, US$ Billion)

Source: Deloitte (2015)

The Ibovespa jumped 45% in the four months leading to the congressional vote for Rousseff’s impeachment. The Brazilian Real, for the first time in three years, strengthened by 13% in the same period – making it the best currency performer of 2016 so far. Brazil’s Central Bank has even taken temporary measures to stop the currency from appreciating too much too quickly, allowing the price of Brazilian exports to remain competitive during this period of political transition. Ultimately over the long-term, the Real will revert to the 2:1 BRL to US$ exchange rate that the BCB openly considers as the best equilibrium. With bolstered investor confidence and a stronger Real, the flash sale of cheap assets characteristic of the last few years in Brazil will soon come to an end.

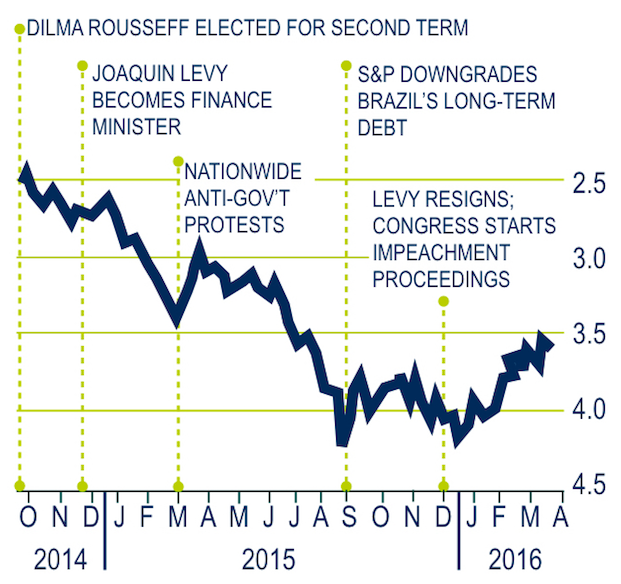

On the Way Up

(Brazilian Real per US$)

Source: Thomson Reuters (2016)

If at least half of the Senate approve the impeachment motion in early May, Rousseff will have to step down for 180 days while the charges against her are investigated. A pro-business politician, Vice President Michel Temer would use this opportunity to implement a liberal economic platform to secure public spending cuts, pension reform and greater private investment. Although these reforms are significant, so too are the fundamental economic drivers that make Brazil an attractive investment destination for the long term. Strong corporate credentials, positive consumption trends and a burgeoning middle class all create the framework for exponential and long-term growth. These factors will remain regardless of how quickly Rousseff leaves office.

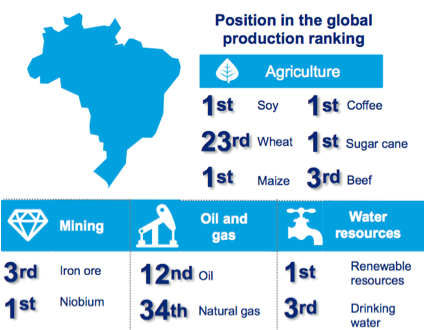

Brazil is a Key Player for Global Resources

Savvy investors will realize this and take advantage of the limited window of opportunity in Brazil while mainstream investors wait until the Real has strengthened and more FDI pours into Brazil (inflating both currency and asset prices). We place ourselves ahead of the curve by finding the future trend rather than waiting for it to happen and missing the opportunity. A rising global population will inevitably look to Brazil to fulfil the increasing need for mankind’s most fundamental resources. Our vision to revolutionize agriculture through our projects will help improve the standard of living around the world and secure optimal and long-term returns for our investors.